The importance of bank checks in the age of digital

Checks issued by banks is a standard in the financial industry for centuries. However, since the advent of electronic technology and online banking, the function of checks has changed. While checks remain a popular method of payment, they are no longer the principal method to pay for the majority of people as well as businesses.

Digital age

In the digital age, Checks are typically viewed as a second or backup type of payment. With the growing acceptance of credit and debit card and internet banking, along with mobile and online payment services, lots of people are finding it easier to use these methods than writing and mailing an actual check. Additionally, many businesses now offer bill pay on a schedule that allows customers to make recurring payments directly through their bank accounts and eliminate the requirement for checks in the first place.

However, despite the shift toward digital payment methods, checks have an important place in today’s financial system. They remain a popular choice among older generations who may not be as comfortable with digital technology. In addition, farm checks are an excellent option for those companies, particularly farm animal-related businesses, who don’t have access to debit or credit cards, or who want a different payment method

Payment backup

Another important role of checks in this age of digital technology is that they can be used as a backup method of payment. In the event of power interruption, internet malfunction, or any other technical problems checks are an alternative to electronic transactions. Furthermore, checks are valuable in situations where electronic transactions aren’t accepted, such as at small businesses or farmers’ markets.

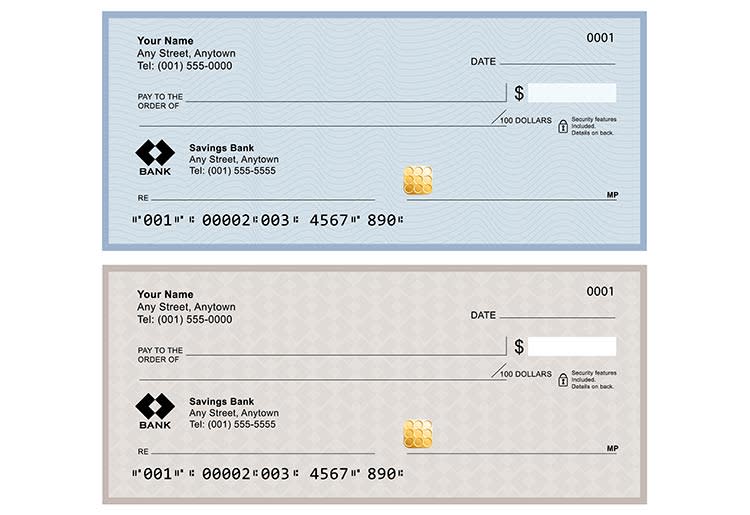

The security function of checks has also retained its importance in this digital age. Checks are equipped with security features like microprints, watermarks, and a special paper stock that makes them difficult to replicate or create. Furthermore, using checks can provide an added layer of security when it comes to payments because they require a signature to be signed and can be traced more easily than digital transactions.

However, it’s important to keep in mind that the use of checks can also pose security issues. checks can be lost or stolen and, if they fall into the wrong hands, they can be used to make illegal payments. Also, checks could be counterfeited or altered and it’s difficult to spot these types of fraud. To reduce the risk It is essential to be vigilant when handling checks and to keep an eye on your bank account for any suspicious activity.

Conclusion

In the end, the use of checkbooks has changed with the age of digital. While checks remain a popular method of payment, they are no longer the main method to pay for the majority of people as well as businesses. They do, however, are a part of the modern financial system as a secondary or backup form of payment and as a security option. It’s essential to be aware of the risks associated with checks and to take steps to protect yourself and your money.